Planning for the future is an essential aspect of life that often takes a backseat to the daily challenges we face. However, considering the unpredictable nature of life, it is crucial to protect your assets and secure your legacy for your loved ones. One highly effective and versatile tool for estate planning is the Revocable Living Trust. In this blog, we will explore the remarkable benefits of a Revocable Living Trust and how it can provide peace of mind while ensuring your wishes are honored.

Understanding the Revocable Living Trust

A Revocable Living Trust is a legal arrangement that allows you (the grantor) to place your assets into a trust during your lifetime. You maintain complete control over these assets and can modify or revoke the trust at any time. Once you pass away, the trust becomes irrevocable, and the assets are distributed to your beneficiaries according to your specified instructions.

Avoiding Probate - The Smooth Transition of Assets

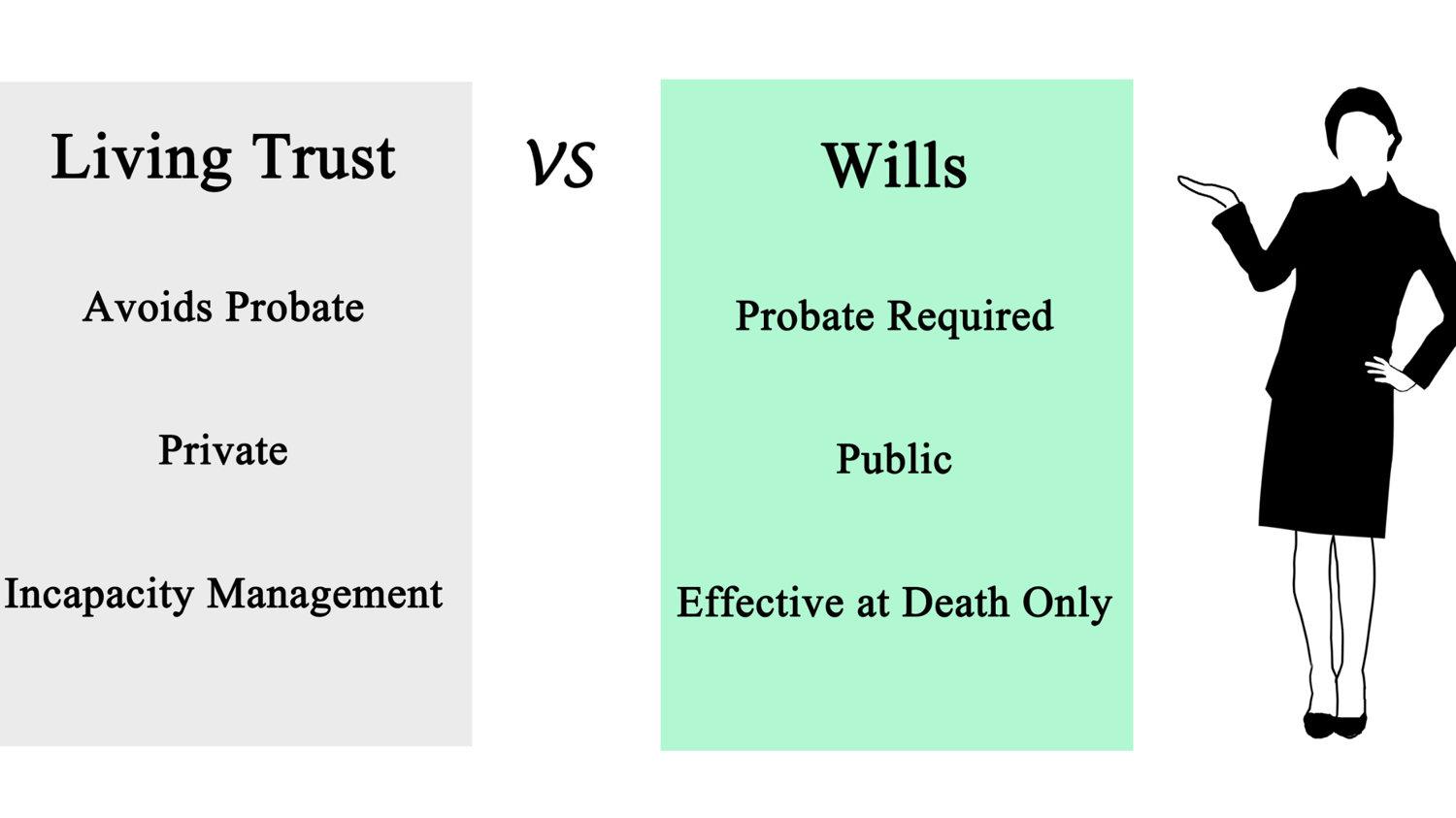

One of the most significant advantages of a Revocable Living Trust is that it helps your estate avoid probate. Probate is the legal process through which the court validates your will, identifies your assets, settles outstanding debts, and distributes your property to beneficiaries. Unfortunately, probate can be a time-consuming, expensive, and public affair, potentially tying up your assets for months or even years.

By using a Revocable Living Trust, your assets can transfer smoothly and efficiently to your beneficiaries without the need for probate. This means your family can avoid the stress and costs associated with probate and access their inheritance much faster.

Maintaining Privacy

Another compelling benefit of a Revocable Living Trust is the privacy it offers. Unlike a will, which becomes a public record after probate, a trust allows your estate to remain confidential. This privacy shield ensures that sensitive information about your assets and their distribution remains within your family, protecting them from unwanted attention or potential disputes.

Incapacity Planning - Ensuring Your Well-being

A Revocable Living Trust is not just about distributing assets after your passing; it also addresses the possibility of incapacity during your lifetime. Through the trust, you can designate a successor trustee to manage your affairs in the event you become incapacitated and are unable to do so yourself. This seamless transition ensures that your financial matters and healthcare decisions are handled according to your wishes.

Flexibility and Control

One of the most attractive features of a Revocable Living Trust is the level of flexibility and control it provides. As the grantor, you have the power to modify the terms of the trust or revoke it entirely if circumstances change. You can add or remove assets, update beneficiaries, and adjust distribution percentages without any significant legal hurdles.

Furthermore, the trust allows you to establish specific conditions for distributing assets to beneficiaries. For example, you can create provisions that ensure beneficiaries receive their inheritance only when they reach a certain age or milestone, or stipulate that assets be used for specific purposes, such as education or healthcare expenses.

Protecting Your Beneficiaries

A Revocable Living Trust is an excellent tool for protecting your beneficiaries, particularly in the case of minor children, individuals with special needs, or financially irresponsible heirs. By placing their inheritance in a trust, you can appoint a responsible trustee to manage the assets on their behalf until they are mature enough to handle the responsibility themselves.

Additionally, a trust can shield your beneficiaries from creditors or lawsuits, ensuring that their inheritance remains intact and safeguarded for their future.

Tax Efficiency and Maximizing Wealth

While a Revocable Living Trust does not provide direct tax benefits, it can be structured to include tax-saving strategies, such as a Credit Shelter Trust (also known as a Bypass Trust) or a Qualified Terminable Interest Property (QTIP) Trust for married couples. These trusts can help minimize estate taxes and maximize the wealth that passes on to your beneficiaries.

Avoiding Will Contests and Family Conflicts

One unfortunate reality of the probate process is the potential for will contests and family conflicts. Disgruntled relatives or individuals who believe they are entitled to a share of your estate may contest your will, leading to lengthy court battles that drain resources and cause emotional distress to your loved ones.

With a Revocable Living Trust, the likelihood of such disputes is significantly reduced. The trust provides a clear and legally binding framework for asset distribution, making it more challenging for dissatisfied parties to challenge your intentions successfully.

A Revocable Living Trust is a powerful and versatile tool that offers numerous benefits for estate planning and ensures your assets are handled according to your wishes during your lifetime and after your passing. From avoiding probate and maintaining privacy to protecting your beneficiaries and maximizing wealth, a trust can provide peace of mind and security for you and your loved ones.

Before establishing a Revocable Living Trust, it is essential to consult with an experienced estate planning attorney who can tailor the trust to your unique needs and goals. By taking this proactive step, you can leave a lasting legacy and protect the financial well-being of your family for generations to come. Start planning today and secure the future you envision!

There is no better time to re-evaluate your current situation than the present. Connect with a licensed financial professional at Alfa Pride Financial, to assess where you are on your financial journey, and get the financial keys to a worry-free life. Get started today and book a call.

About the Author

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Comments ()