In the hustle and bustle of daily life, financial planning often takes a backseat. However, for parents at all stages of life, establishing a comprehensive financial plan is paramount. It serves as a roadmap to secure their family's future and naviga...

Read More

Personal Finance

In the dynamic landscape of entrepreneurship, small to medium-sized businesses (SMBs) stand as the backbone of economies worldwide. Despite their agility and innovation, these enterprises often encounter significant challenges in sustaining and expan...

Read More

As we approach the end of the year, it's the perfect time to reflect on our financial journey and make strategic moves to set ourselves up for success in the coming year. Year-end financial planning is a crucial aspect of personal finance that often ...

Read More

Retirement, often hailed as the golden period of life, comes with the promise of relaxation, exploration, and freedom from the daily grind. However, as retirees, it's crucial to be mindful of potential risks that can impact the sustainability of your...

Read More

In the journey towards financial well-being, individuals often find themselves at a crossroads—should they prioritize paying off debt or focus on building wealth? The answer isn't always clear-cut, as both avenues hold their own merits and drawbacks....

Read More

The holiday season is a time of joy, togetherness, and of course, gift-giving. While it's wonderful to show our love and appreciation to friends and family through presents, the costs can quickly add up. The good news is that with some savvy strategi...

Read More

Retirement is a phase of life that many people eagerly look forward to. It's a time to relax, enjoy life, and finally reap the rewards of years of hard work. But there's a looming concern that can dampen the spirit of retirement - taxes. In...

Read More

It’s easy to think that financial planning is only for the wealthy - those with millions in assets to manage and grow. But the truth is, financial planning is for everyone, regardless of income level or net worth. Proper financial planning can help y...

Read More

In the unpredictable and often challenging world of economics, recessions can strike like a sudden storm, leaving financial havoc in their aftermath. A recession is a significant decline in economic activity that can have far-reaching consequences fo...

Read More

Every parent dreams of providing the best opportunities for their children, and a college education is often one of the most significant investments in their future. However, the rising costs of higher education can be overwhelming. To ensure your ch...

Read More

Retirement planning is a critical aspect of financial security and peace of mind, but what if you don't have access to a 401(k) plan through your employer? Don't despair; there are plenty of alternative options to help you save for retireme...

Read More

Financial security and independence are goals that most of us aspire to achieve. Yet, many individuals find themselves facing financial challenges and setbacks, often due to common financial mistakes. In this blog post, we will explore some of the to...

Read More

Retirement planning is a crucial phase of life, and it comes with a unique set of challenges. One of the often-overlooked risks that can significantly impact your retirement nest egg is sequence of returns risk. In this blog post, I'll explain what s...

Read More

In today's fast-paced world, financial management is a crucial skill that everyone should strive to master. Whether you're a recent graduate starting your first job, a seasoned professional looking to take control of your finances, or somewhere in be...

Read More

In the realm of real estate, the term "foreclosure" often carries a sense of apprehension and uncertainty. It's a process that signifies financial distress, where homeowners face the possibility of losing their homes due to unpaid mortgages. However,...

Read More

Imagine waking up one day to the incredible news that you are the lucky winner of a staggering $1.28 billion Mega Millions jackpot! Suddenly, your life has taken an extraordinary turn, and it's essential to handle this life-changing event with utmost...

Read More

No one likes to think about their own mortality, but it's an inevitable reality we all must face. When you pass away, the last thing you want to leave behind is a burden of debt for your loved ones to handle. While planning for the future may seem da...

Read More

Planning for the future is an essential aspect of life that often takes a backseat to the daily challenges we face. However, considering the unpredictable nature of life, it is crucial to protect your assets and secure your legacy for your loved ones...

Read More

When the dark clouds of financial distress Hover over a homeowner, foreclosure can be a sad and stressful reality. The experience of losing one's cherished home is emotionally taxing and financially crippling. However, many homeowners may not know th...

Read More

Building generational wealth is a dream shared by many, yet only a select few manage to achieve it. While there's no magic formula, there are proven strategies that can pave the way to lasting prosperity for your family and future generations. In thi...

Read More

As parents, we strive to provide our children with the best possible foundation for a successful and fulfilling life. While traditional education equips them with academic knowledge, one critical aspect often overlooked is financial literacy. In toda...

Read More

Disclosure: This article contains affiliate links, which means that if you click on them and make a purchase, we may earn a commission at no additional cost to you. We only recommend products or services that we believe can provide value to readers. ...

Read More

As we are in graduation season, finding the perfect gift for a recent graduate can be a challenging task. While traditional gifts like books or gadgets are always appreciated, why not consider a gift that will set them on the path to financial succes...

Read More

In today's digital age, where financial transactions are predominantly conducted online, it is crucial to prioritize the security of your finances. Cybercrime poses a significant threat, with hackers and scammers constantly devising new tactics to ex...

Read More

Managing healthcare costs can be a significant financial burden for individuals and families. To alleviate some of these expenses, many employers offer flexible spending accounts (FSAs) and health savings accounts (HSAs). While both accounts aim to a...

Read More

Life Insurance

When it comes to life insurance, most people associate it with providing financial protection to their loved ones in the event of their passing. While that is undoubtedly a crucial aspect, life insurance also comes with a range of living benefits tha...

Read More

Life insurance has been the subject of much debate and skepticism in recent years, with some individuals questioning its legitimacy. In this blog, I aim to dispel the notion that life insurance is a scam and provide evidence to support its importance...

Read More

Financial planning is a complex and multifaceted process that involves managing income, expenses, investments, and insurance, among other elements. While many people are familiar with traditional life insurance, there's another tool that can play a v...

Read More

When it comes to financial planning, few topics generate as much confusion and misinformation as life insurance. Many people shy away from purchasing life insurance due to misconceptions that have been perpetuated over the years. In this blog, we wil...

Read More

Life insurance is a powerful financial tool that provides a safety net for your loved ones after you're gone. Beyond its primary function of ensuring financial security, it can also offer numerous tax benefits. Understanding how life insurance p...

Read More

Life is a beautiful journey filled with unpredictable twists and turns. As we navigate through its complexities, we often forget to consider the importance of securing our loved ones' future in case the unexpected happens. That's where Life Insurance...

Read More

Financial security and peace of mind are universal aspirations. We work hard to provide for ourselves and our loved ones, safeguarding our future against the uncertainties that life may throw our way. One of the essential tools for achieving this sec...

Read More

In the maze of life insurance options available today, Simplified Issue Life Insurance policies stand out for its simplicity and accessibility. If you're unfamiliar with this term, in this blog post, we're going to delve deep into the world of simpli...

Read More

In a world where financial security is paramount, insurance plays a vital role in safeguarding our loved ones' futures. Among the many insurance providers, there exists a remarkable institution with a rich history, a strong sense of community, and a ...

Read More

Life insurance is an essential financial safety net that provides peace of mind to individuals and their loved ones. It ensures that, in the event of the policyholder's untimely demise, their family is financially protected from potential hardships. ...

Read More

Life insurance is a crucial financial tool that offers protection and peace of mind to you and your loved ones. It ensures that your family's financial well-being is safeguarded in the event of your untimely demise. However, with numerous types of po...

Read More

Life insurance is an essential financial tool that provides peace of mind and financial security to individuals and their loved ones. However, many people wonder if they can obtain life insurance if they have pre-existing medical conditions. The good...

Read More

Life insurance is an essential financial tool that provides financial security and peace of mind for individuals and their loved ones. However, before you can secure the coverage you need, you must first navigate the life insurance application proces...

Read More

In today's uncertain world, securing your family's financial future is of utmost importance. One effective way to achieve this is by incorporating term life insurance into your financial plan. While it may seem complex, term life insurance offers a s...

Read More

Life insurance is a crucial financial tool that provides protection and peace of mind to individuals and their loved ones. While the topic may seem complex, this blog aims to demystify the workings of life insurance. We will explore the fundamental c...

Read More

When it comes to life insurance, choosing the right provider is crucial. The policy you choose will play a major role in securing the future of your loved ones, so it's important to find a company you can trust. MassMutual Life Insurance is a top-rat...

Read More

Death is an inevitable part of life, and it is important to be prepared for the financial costs that come with it. Final expense insurance is a type of insurance that is designed to help cover the costs of a person's funeral, burial, and other e...

Read More

When it comes to protecting your loved ones' financial security, life insurance is a crucial investment. American National offers a variety of life insurance products that cater to different needs and budgets. However, like any financial decisio...

Read More

Indexed universal life insurance (IUL) is a type of life insurance policy that combines the death benefit protection of traditional life insurance with the potential for cash value growth based on the performance of a stock market index. It's a ...

Read More

Whole life insurance is a popular option for those seeking a long-term solution to protect their family’s financial future. This type of policy provides lifelong coverage and a range of benefits that can help you and your family in the years to come....

Read More

ERNST & YOUNG RESEARCH PAPER: BENEFITS OF INTEGRATING LIFE INSURANCE PRODUCTS INTO A RETIREMENT PLAN

Ernst & Young (EY) has just released new groundbreaking, independent, and unbiased research on financial planning. Their perspective is clear, a financial plan that combines permanent life insurance (PLI), income annuities, and investments are mo...

Read More

Buying insurance of any kind is often confusing. In order to compare policies by price, you have to be sure that each policy carries the same benefits for the same amount, and figure in a dozen different factors. It’s enough to set your head spinning...

Read More

The thought that your children could pre-decease you is something no parent wants to consider. Unfortunately, it is a reality that many parents had to confront in their lives. To prepare for this unexpected tragedy, many parents purchase life insuran...

Read More

Don’t let these five misconceptions delay you from protecting your loved ones with life insurance.More people are preparing for the unexpectedThe untimely death of a loved one once seemed like a remote possibility. But the pandemic has brought a new ...

Read More

Is coverage as expensive as people think? The numbers might surprise you.Pop quiz: How much do you know about life insurance? Ask yourself these questions—and then find out the facts.How many people own life insurance?Most Americans overestimate the ...

Read More

Annuities

Annuities have become an increasingly popular financial tool for individuals seeking a stable and guaranteed income stream in retirement. Whether you're nearing retirement or planning for the future, understanding the nuances of annuities, including ...

Read More

Retirement planning is a topic of paramount importance for anyone seeking financial security in their later years. Two popular options for generating retirement income are dividend-paying stocks and annuities. Both come with their advantages and disa...

Read More

Retirement planning is a complex and multifaceted process. One of the most significant concerns for retirees is ensuring that they have a consistent stream of income throughout their retirement years. Annuities can play a crucial role in achieving th...

Read More

When it comes to securing your financial future, planning for retirement is paramount. Among the various options available, annuities stand out as a popular choice for many individuals. Annuities offer a unique way to receive a steady stream of incom...

Read More

In today's uncertain economic landscape, ensuring a stable and secure financial future has become a top priority for individuals of all ages. Retirement planning, in particular, has taken center stage as people seek to safeguard their savings and inv...

Read More

When it comes to secure investments, many individuals turn to certificates of deposits (CDs) as a reliable option. However, there's another financial instrument worth exploring: annuities. Annuities offer unique advantages that go beyond what CDs can...

Read More

Individual Retirement Accounts (IRAs) offer individuals an opportunity to save for retirement while enjoying potential tax advantages. One option within the realm of IRAs is an IRA annuity. In this blog post, I will delve into the world of IRA annuit...

Read More

Annuities are financial products that provide a steady stream of income during retirement. They can offer various tax advantages, depending on their classification. Two common types of annuities are tax-sheltered annuities (TSAs) and non-qualified an...

Read More

Fixed-indexed annuities (FIAs) have gained significant attention in recent years as a popular financial tool for retirement planning. Designed to provide individuals with both protection and growth potential, FIAs offer a unique combination of featur...

Read More

Fixed annuities are a popular financial tool that can provide individuals with a reliable and steady income stream during their retirement years. In this blog, I will explore the ins and outs of fixed annuities, including what they are, how they work...

Read More

In the world of financial planning, deferred income annuities (DIAs) have gained considerable attention as a reliable tool for securing a stable income stream during retirement. As individuals seek ways to ensure financial security and peace of mind ...

Read More

In today's uncertain economic climate, planning for retirement has become increasingly important. Immediate annuities have emerged as a popular option for individuals seeking financial security during their retirement years. These annuities offer a s...

Read More

Market volatility can be a major concern for many people, especially when it comes to their retirement savings. With the stock market constantly fluctuating, it's hard to know how much money you'll have when you're ready to retire. Tha...

Read More

Retirement planning can be a daunting task, but it's essential to secure your financial future. One of the investment options available to help achieve this goal is annuities. In this article, we’ll explore the benefits of annuities and how they...

Read More

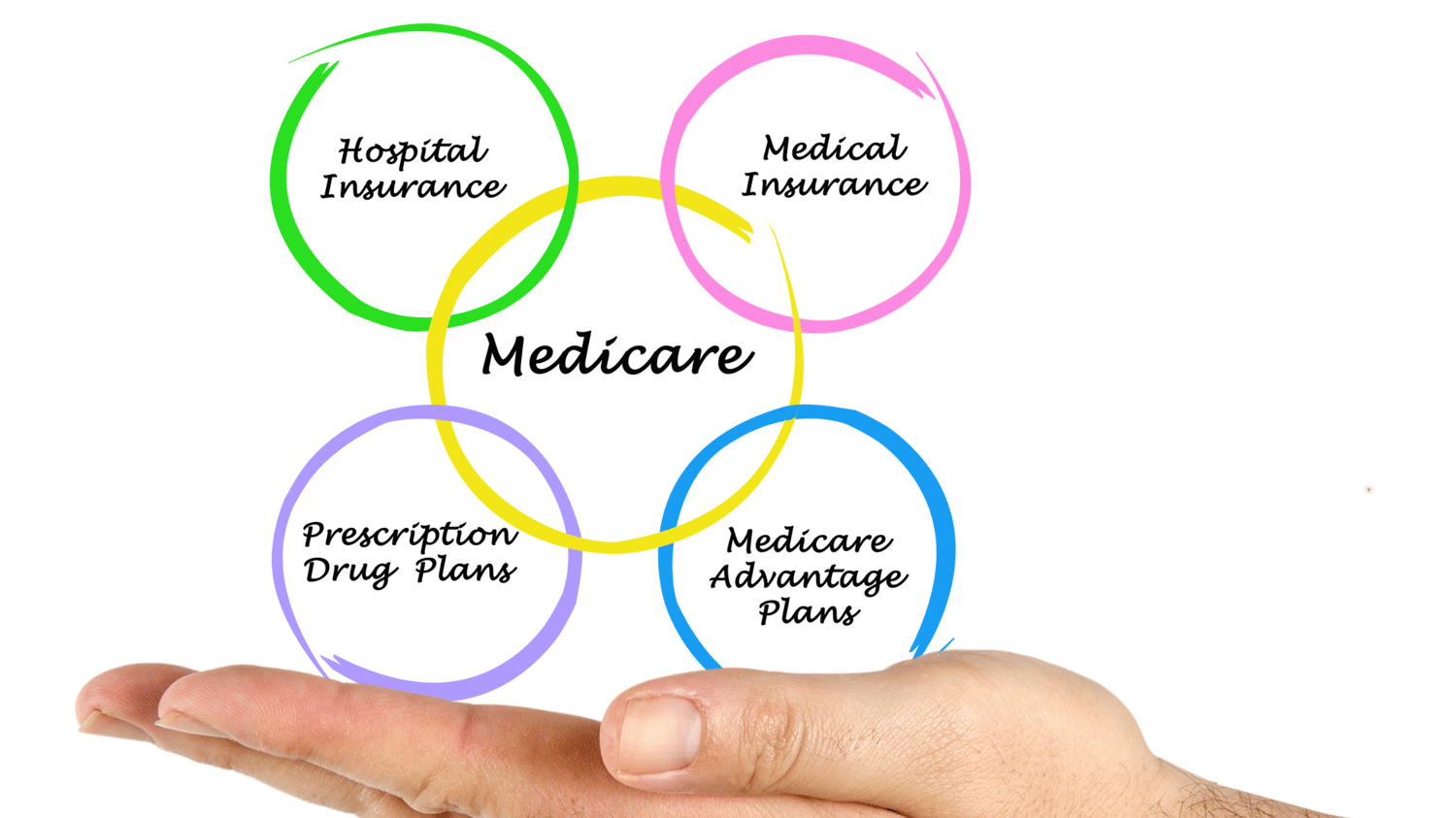

Healthcare

As we age, ensuring access to quality healthcare becomes increasingly important. For many seniors in the United States, Medicare Advantage plans offer a comprehensive and convenient alternative to traditional Medicare. To make the most of these benef...

Read More

Medicare, the government-sponsored health insurance program, plays a crucial role in providing healthcare coverage to millions of Americans. While many are familiar with its existence, there are several aspects of Medicare that the majority of benefi...

Read More

As individuals approach the age of 65, the intricacies of healthcare choices can become overwhelming. Medicare offers various plans to cater to different needs, and one such option is Medicare Part C, also known as Medicare Advantage. In this compreh...

Read More

Reaching the age of 50 is a milestone in one's life. It often signifies a period of reflection and planning for the future, particularly when it comes to healthcare and financial security. One crucial aspect that often goes overlooked is the nee...

Read More

Health insurance is one of the most vital safeguards for your well-being and financial security. It ensures that you have access to the medical care you need when you need it, without the burden of exorbitant costs. However, simply having health insu...

Read More

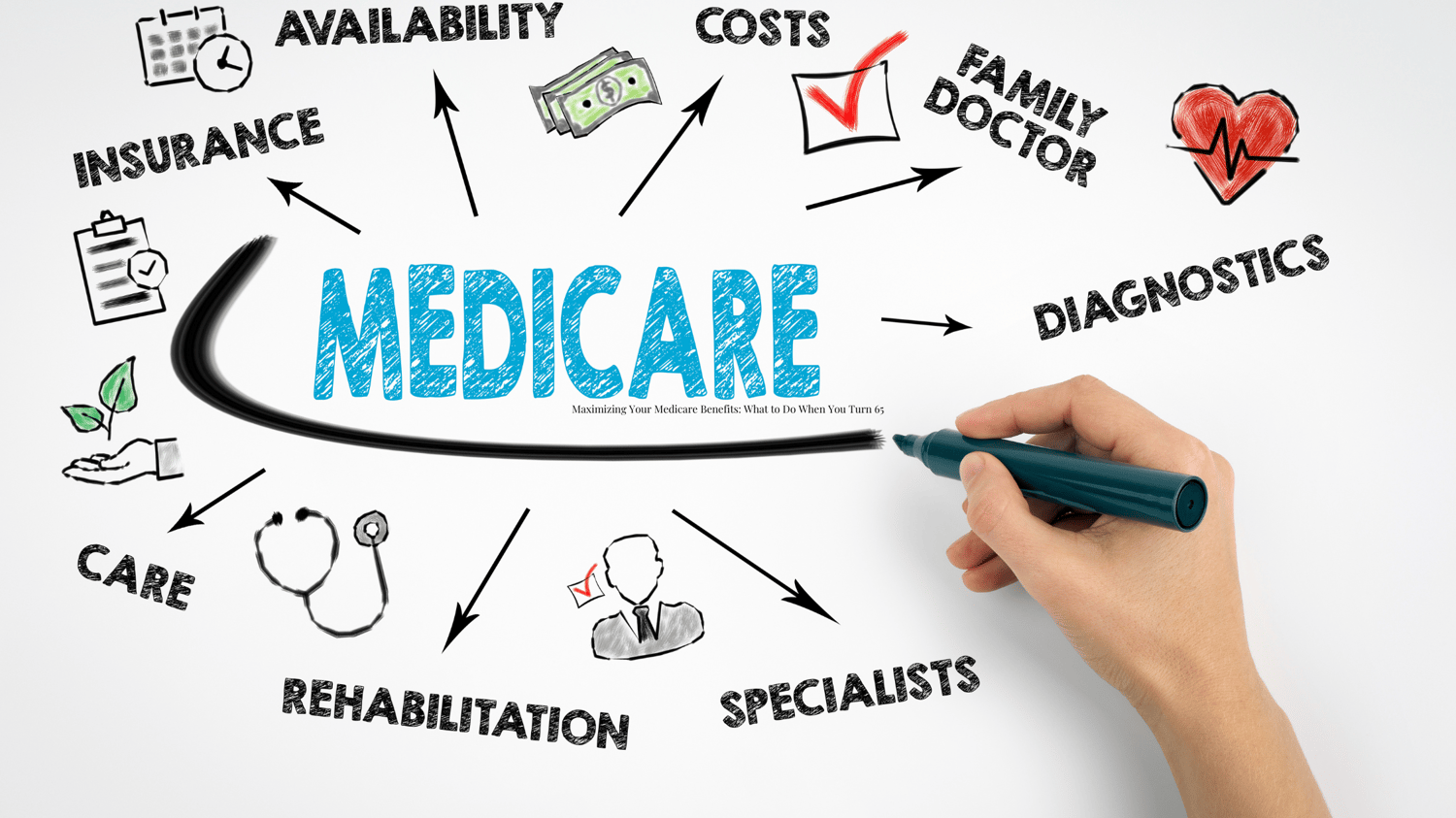

Turning 65 and becoming eligible for Medicare is an important milestone in your life. However, navigating the complexities of Medicare can be overwhelming for many individuals. To ensure you make the most of this valuable healthcare program, it's cru...

Read More

As you approach 65, the age at which you become eligible for Medicare, it is important to understand your options and make informed decisions about your healthcare coverage. At age 65, Medicare becomes your primary form of insurance by law, once you ...

Read More

If you don't love your Medicare plan or need to change it for whatever reason, when are you allowed to make that change and how do you switch plans?Many people love their Medicare plan. It offers them the coverage they need for a price they can ...

Read More

Original Medicare covers many things, but not everything. These are the services that Medicare usuallydoesn’t offer coverage for.One of the things that makes Medicare such a useful healthcare solution for seniors and eligiblecitizens is the comprehen...

Read More

CMS’ new effective date rules could mean a smoother Medicare enrollment process for you. Starting in 2023, beneficiaries enrolling during the last three months of their Initial Enrollment Period or the General Enrollment Period can start their covera...

Read More