Every parent dreams of providing the best opportunities for their children, and a college education is often one of the most significant investments in their future. However, the rising costs of higher education can be overwhelming. To ensure your child's educational dreams become a reality, it's crucial to start saving early and explore various options. In this blog, we will delve into the top ways to save for your children's college education, with a particular focus on the benefits of cash-value life insurance as a powerful tool in your savings arsenal.

The Soaring Cost of College Education

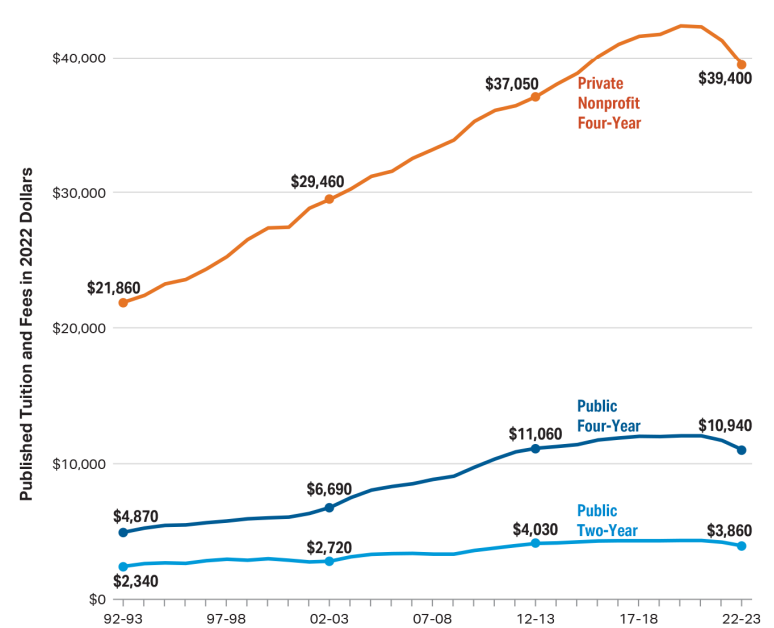

Before we discuss saving strategies, let's take a moment to understand why early and strategic saving for college education is imperative. According to the College Board, the average cost of tuition and fees at a four-year public college in the United States was approximately $10,560 for in-state students during the 2020-2021 academic year. For private colleges, that figure jumped to an astonishing $37,650.

Now, consider this: College costs have been steadily rising over the years, consistently outpacing inflation. It's estimated that by the time today's infants reach college age, a four-year public education could cost over $200,000, while private colleges could exceed $500,000. These staggering numbers underscore the necessity of early and effective college savings strategies.

Average Published Tuition and Fees in 2022 Dollars by Sector, 1992-93 to 2022-23

Source: College Board, Trends in College Pricing and Student Aid 2022, Figure CP-2

Top Ways to Save for Your Children's College Education

529 College Savings Plans

One of the most popular and tax-advantaged methods of saving for college is the 529 College Savings Plan. These state-sponsored plans offer several benefits:

Tax-free growth: Earnings in a 529 plan are not subject to federal taxes when used for qualified educational expenses.

State tax deductions: Some states offer tax deductions or credits for contributions to 529 plans.

Flexibility: Funds can be used at accredited colleges nationwide for tuition, room and board, books, and other qualified expenses.

Custodial Accounts (UGMA/UTMA)

Uniform Gift to Minors Act (UGMA) and Uniform Transfer to Minors Act (UTMA) accounts allow parents to invest on behalf of their children. While they lack some of the tax advantages of 529 plans, they offer greater flexibility in terms of investment options and usage of funds.

Scholarships and Grants

Encourage your child to excel academically and seek out scholarships and grants. Many universities and organizations offer financial assistance based on merit, talent, or need. Research available opportunities well in advance.

Regular Savings Accounts

While not as tax-efficient as 529 plans, traditional savings accounts can be a straightforward way to save for college. Set up automatic transfers from your checking account to a dedicated savings account to ensure consistent contributions.

Cash Value Life Insurance

Cash value life insurance is an often-overlooked yet powerful tool for saving for your child's education. This type of life insurance provides not only a death benefit but also a cash value component that can grow over time. Here's why it deserves a closer look:

Tax advantages: The cash value of a life insurance policy grows tax-deferred. When you withdraw funds, you may do so tax-free up to the amount you've paid in premiums.

Flexibility: You can access the cash value at any time, for any purpose, including college expenses.

Protection: In the unfortunate event of the policyholder's death, the death benefit can help cover college costs and provide financial security for the family.

Guarantees: Some life insurance policies offer guaranteed minimum interest rates, ensuring that your savings grow over time, regardless of market fluctuations.

The Power of Cash Value Life Insurance

Cash value life insurance, such as whole life or universal life, provides a unique combination of protection and savings. While it's primarily designed to provide a death benefit to your beneficiaries, it offers a host of advantages when it comes to college savings.

Consider this scenario: You purchase a cash-value life insurance policy when your child is young. Over the years, the cash value component grows, thanks to interest and investment earnings. By the time your child is ready for college, you can access these funds tax-free to cover tuition, room and board, or any other expenses they may incur.

Additionally, life insurance policies offer peace of mind. In the event of your untimely passing, your child will receive the death benefit, which can serve as a financial safety net to cover educational costs and other family needs.

The cost of a college education is steadily rising, making early and strategic savings essential. While options like 529 plans and scholarships are valuable, cash-value life insurance stands out as a versatile tool that provides tax advantages, flexibility, and protection for your child's future.

As a parent, it's your responsibility to ensure your child's dreams become a reality. By combining different savings strategies, including cash value life insurance, you can take proactive steps toward securing their educational future. Don't wait – start planning today, and invest in your child's bright tomorrow.

There is no better time to re-evaluate your current situation than the present. Connect with a licensed financial professional at Alfa Pride Financial, to assess where you are on your financial journey, and get the financial keys to a worry-free life. Get started today and book a call.

About the Author

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Comments ()