Turning 65 and becoming eligible for Medicare is an important milestone in your life. However, navigating the complexities of Medicare can be overwhelming for many individuals. To ensure you make the most of this valuable healthcare program, it's crucial to understand the steps to take when you first become eligible. In this comprehensive guide, I will walk you through the necessary actions you should consider, empowering you to make informed decisions and maximize your Medicare benefits.

Understanding Your Medicare Options:

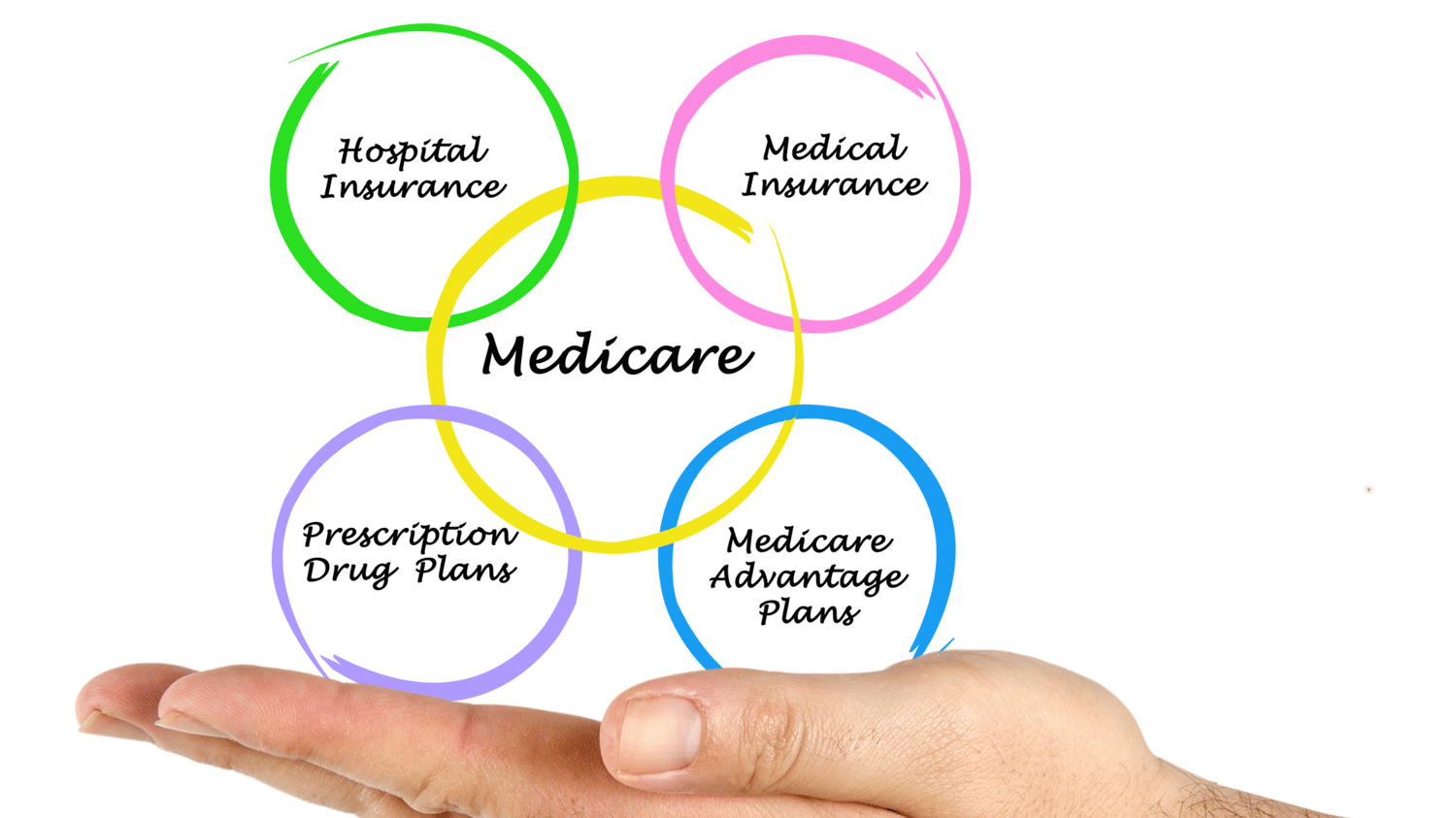

When you become eligible for Medicare, it's essential to understand the different parts and coverage options available to you. Medicare consists of four parts: Part A, Part B, Part C (Medicare Advantage), and Part D (Prescription Drug Coverage).

Medicare Part A: This covers hospital stays, skilled nursing facility care, and some home health services. Most individuals do not pay a premium for Part A if they or their spouse have paid Medicare taxes for 40 quarters while working, which is equivalent to 10 years.

Medicare Part B: This covers medical services like doctor visits, preventive care, and outpatient services. It requires a monthly premium, which may vary based on your income. It is advisable to enroll in Part B during your Initial Enrollment Period to avoid late enrollment penalties.

Medicare Part C: Also known as Medicare Advantage, this is an alternative to Original Medicare (Part A and Part B) and offers additional benefits. Medicare Advantage plans are offered by private insurance companies and typically include prescription drug coverage (Part D) and may provide additional services like dental or vision care.

Medicare Part D: This provides prescription drug coverage, which is crucial for individuals who take medications regularly. It is available as a standalone plan or as part of a Medicare Advantage plan. It is essential to review different Part D plans to find one that covers your specific medications at the most affordable cost.

Medicare Supplement Plans: Enhancing Your Coverage:

In addition to the standard Medicare coverage, you can enroll in Medicare Supplement plans, also known as Medigap plans. These plans are offered by private insurance companies and are designed to fill the gaps in Original Medicare coverage, including deductibles, coinsurance, and copayments.

Here are some key points to consider about Medicare Supplement plans:

Supplementing Original Medicare: Medicare Supplement plans work alongside Original Medicare (Part A and Part B). They help cover the out-of-pocket costs that you would otherwise be responsible for paying, such as deductibles and coinsurance.

Standardized Plans: Medicare Supplement plans are standardized and labeled with letters (Plan A, Plan B, etc.). Each plan offers a specific set of benefits, regardless of the insurance company you choose. This allows you to compare plans easily and ensures that the coverage remains consistent.

Freedom to Choose Providers: With Medicare Supplement plans, you have the freedom to visit any doctor or hospital that accepts Medicare patients. You are not limited to a specific network of providers, as is the case with some Medicare Advantage plans.

Monthly Premiums: Medicare Supplement plans require a monthly premium in addition to the premium for Part B. The cost of the premium may vary depending on the plan you choose and the insurance company.

Guaranteed Issue Rights: When you first become eligible for Medicare, you have a six-month Medigap Open Enrollment Period, during which you have guaranteed issue rights. This means that insurance companies cannot deny you coverage or charge higher premiums based on pre-existing conditions.

Researching and Comparing Plans:

Once you understand the different parts of Medicare, enrollment periods, and the option of Medicare plans, it's time to research and compare your coverage options to find the best fit for your healthcare needs. Consider the following steps:

Assess Your Healthcare Needs: Evaluate your current health condition, anticipated medical needs, and prescription medications. This assessment will help you determine which coverage options are most suitable for you.

Compare Medicare Advantage and Medicare Supplement Plans: If you're considering Medicare Advantage, research and compare plans offered in your area. Similarly, explore the available Medicare Supplement plans and their corresponding benefits. Consider factors such as premiums, deductibles, copayments, network providers, additional benefits, and quality ratings.

Seek Professional Guidance: Consulting with a licensed insurance agent or Medicare specialist can provide valuable insights and guidance throughout the decision-making process. They can help answer your questions, compare plans, and ensure you make an informed choice.

Maximizing Your Medicare Benefits:

Once you've enrolled in Medicare and selected your coverage options, there are additional steps you can take to make the most of your benefits:

Utilize Preventive Services: Medicare covers a range of preventive services, including screenings, vaccinations, and wellness visits. Take advantage of these services to detect potential health issues early and maintain your well-being.

Stay Informed: Keep up-to-date with changes to Medicare policies, coverage, and enrollment periods. The Centers for Medicare & Medicaid Services (CMS) website is an excellent resource for information.

Review Your Coverage Annually: Your healthcare needs may change over time, so reviewing your coverage annually during the Annual Election Period (AEP) is important. Ensure your plan still meets your needs and consider making changes if necessary.

Explore Additional Assistance Programs: Depending on your income and resources, you may be eligible for additional programs such as Extra Help, which assists with prescription drug costs, or Medicare Savings Programs which help cover Medicare premiums and other expenses.

Becoming eligible for Medicare opens the door to comprehensive healthcare coverage. By understanding your options, and enrollment periods, and doing thorough research, you can make informed decisions and select the best Medicare plan for your needs. Medicare Supplement plans offer additional coverage options to enhance your benefits and provide financial protection. Remember to stay engaged with your healthcare, review your coverage annually, and seek guidance when needed. By following these steps, you can navigate the Medicare system with confidence and ensure you receive the maximum benefits available to you.

There is no better time to re-evaluate your current situation than the present. Connect with a licensed financial professional at Alfa Pride Financial, to assess where you are on your financial journey, and get the financial keys to a worry-free life. Get started today and book a call.

About the Author

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Comments ()