When it comes to secure investments, many individuals turn to certificates of deposits (CDs) as a reliable option. However, there's another financial instrument worth exploring: annuities. Annuities offer unique advantages that go beyond what CDs can provide. In this blog, we will delve into the world of annuities and explore why they can be a better choice for long-term financial growth and stability. We will compare annuities and CDs across various factors, including returns, tax benefits, flexibility, and inheritance. So let's discover the benefits that annuities offer and why they may be a superior investment strategy.

Higher Potential Returns

While CDs are known for their guaranteed returns, annuities have the potential to offer higher returns over the long term. Annuities can provide a range of investment options, allowing investors to diversify their portfolios and potentially earn higher returns. CDs, on the other hand, typically offer fixed interest rates, which may not keep pace with inflation or provide substantial growth opportunities. Annuities' ability to generate higher returns makes them an attractive option for those looking to maximize their investments and secure a better financial future.

Tax Advantages

Annuities often come with significant tax advantages compared to CDs. While the interest earned from CDs is subject to federal and state income taxes, annuities offer tax-deferred growth. This means that earnings on the invested principal are not taxed until withdrawals are made. Moreover, annuities can provide additional tax benefits such as tax-free exchanges between annuity contracts and the ability to name a beneficiary who can receive the annuity proceeds without going through probate. These tax advantages make annuities a powerful tool for individuals seeking tax-efficient growth and planning for their financial legacies.

Flexibility and Customization

Unlike CDs, annuities offer a wide range of options and flexibility to suit investors' specific needs. With annuities, you can choose between fixed, variable, or indexed options, allowing you to align your investment strategy with your risk tolerance and financial goals. Additionally, annuities can offer features such as guaranteed minimum income benefits, death benefits, and flexible withdrawal options. These features provide a level of customization and control that CDs simply cannot match, making annuities a more versatile investment vehicle.

Retirement Income and Longevity Protection

One of the significant advantages annuities have over CDs is their ability to provide a steady stream of income during retirement. Annuities can be structured to offer guaranteed income for life, protecting individuals from outliving their savings. This feature is particularly beneficial in an era where people are living longer and need sustainable income sources to maintain their lifestyles. While CDs have a fixed maturity date and provide a lump sum payment, annuities can offer a lifelong income stream, making them a powerful tool for retirement planning and securing financial stability in the long run.

Inheritance and Legacy Planning

When it comes to leaving a financial legacy, annuities have clear advantages over CDs. While CDs typically pass through probate and may be subject to estate taxes, annuities allow beneficiaries to receive the proceeds directly, bypassing probate. Additionally, annuities can offer features like guaranteed minimum death benefits, ensuring that a certain amount is passed on to beneficiaries. By contrast, CDs lack such customization options for inheritance planning. Annuities provide a seamless and efficient way to transfer wealth to the next generation while minimizing potential tax burdens.

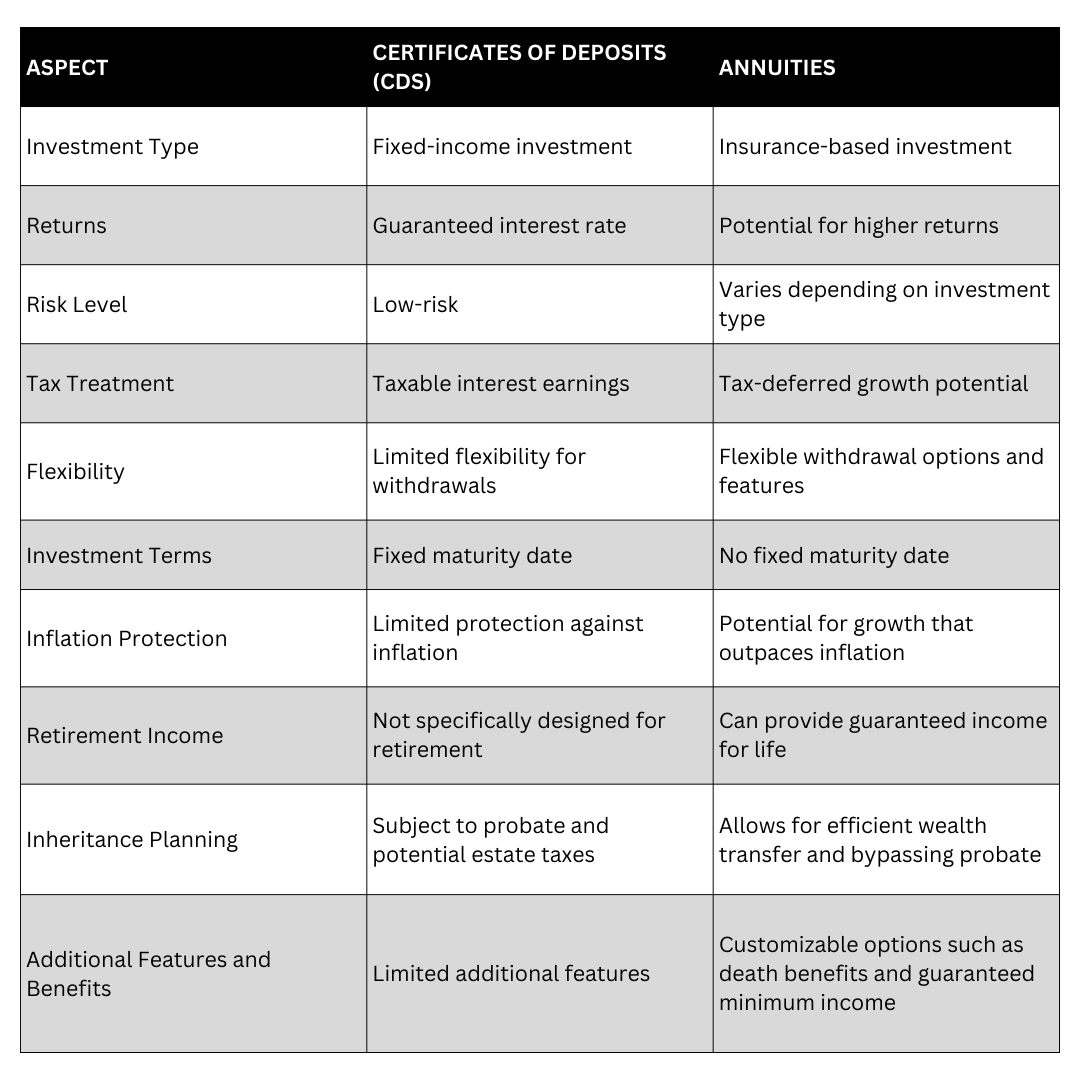

Annuities VS CDs

While certificates of deposits have their merits as secure investments, annuities offer a range of advantages that make them superior in several key areas. From potential higher returns and tax advantages to flexibility and customization, annuities present a compelling case for long-term financial growth and security. By considering the unique benefits that annuities bring to the table, individuals can make more informed decisions about their investment strategies and pave the way for a brighter financial future.

There is no better time to re-evaluate your current situation than the present. Connect with a licensed financial professional at Alfa Pride Financial, to assess where you are on your financial journey, and get the financial keys to a worry-free life. Get started today and book a call.

About the Author

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Comments ()