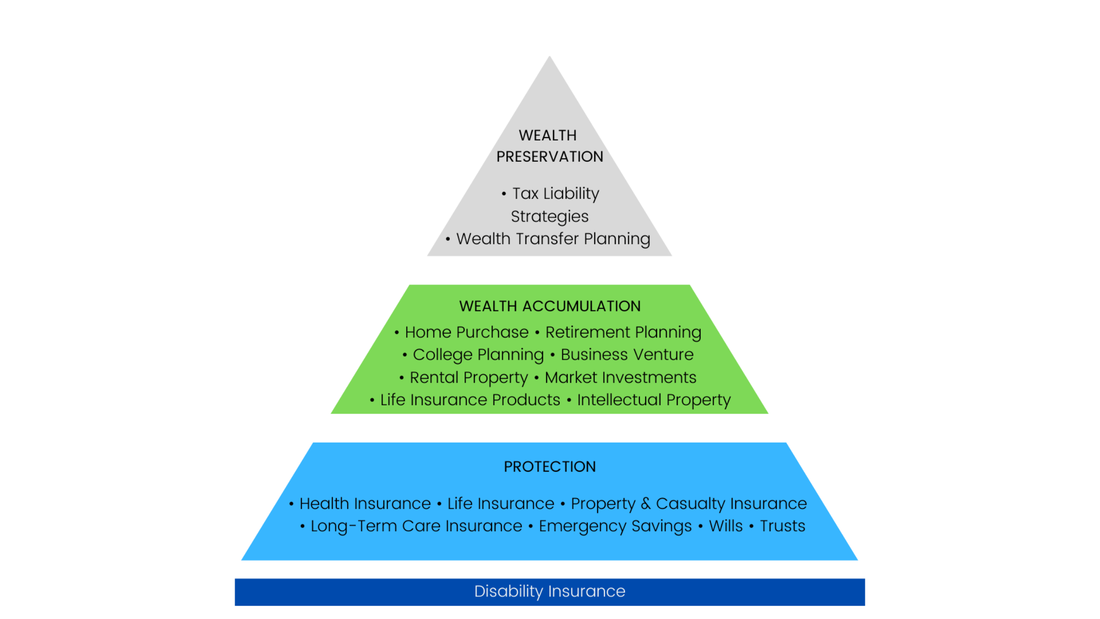

When you're on your financial journey, you need a financial GPS to properly guide you to your destination. Without the right financial roadmap, you can lose sight of the end goal and fall off track. The Financial Planning Pyramid serves as a general guide to anyone interested in securing their financial future.

PROTECTION

Like a good home, financial security starts with a solid foundation. You need protection against illness or injury that keeps you from work. You also need assurance that your family will be taken care of if you’re no longer there to provide for them.

One of the most important factors in achieving your financial goals may be protecting your income. That’s why it’s a foundational element of a sound financial plan.

Income protection comes in several forms. In the event you’re unable to work because of an illness or injury, your paycheck can be protected by disability income insurance. It can supplement your family’s income until you’re able to return to work.

And while it can be unpleasant to think about, the same needs would be even greater if you were to pass away. Like disability income protection, life insurance can provide you and your family assurance their needs will be provided for.

Together, disability income insurance and life insurance form the foundation of a sound financial strategy, helping to ensure your loved ones are taken care of and your family’s financial goals stay on track if the unexpected happens.

Other forms of protection you need in-place help to lower exposure to health, property, and age related risks. Lowering your risk of loss due to unemployment makes it important to have an emergency savings fund to maintain your lifestyle until you secure a new job. Putting a will and a trust in place eliminates the risk of your assets not being transferred to your benefactors appropriately.

WEALTH ACCUMULATION

Once your protections are in place, you then transition to the wealth accumulation phase of your financial plan. This is where you look to acquire assets such as a home and implement ways to build a nest egg for retirement. Participating in an employer-sponsored retirement plan such as a 401K or 403b provides free funds to augment your own savings efforts.

Contributing to your own individual retirement account and investing in mutual funds, stocks and other vehicles allows you to put your money to work for you by earning more money. Assets such as annuities allow you to safeguard the money you’ve accumulated and convert it into a guaranteed stream of income for the duration of your retirement to eliminate the risk of outliving your money in retirement.

In this phase, you may also look into launching a business venture to earn profit income. Other things you can do include investing in real estate to earn profit with rental income. Creating some form of intellectual property in the form of books, music or art can also generate royalty income to help grow your wealth. During this phase, you may also start college planning if you have children and implement ways to fund their higher education.

WEALTH PRESERVATION

As you transition to the wealth preservation stage, you must give serious thought to how you will lower your tax liabilities. Taxation and overexposure to it can seriously impact your finances in multiple ways in all stages of your life. When it comes to investing your money to grow for you, there are four stages.

There is the contribution stage where you are putting your money into an investment of choice. There is the accumulation stage where your money is growing in the investment. There is the distribution stage where money is withdrawn from the asset and converted to income. Finally, there is the wealth transfer stage when your assets are passed on to your beneficiaries.

Different financial assets subject you to taxation in one or more of those stages which dictate how the investment will grow, how much income it can generate, and how much of it will be passed on to your heirs. Your assets will fall into one or more of these categories: tax me now, tax me later and tax me never. This will be discussed in a future post.

Your tax liability strategy should diversify your exposure to taxation as much as possible to safeguard what you have accumulated thus far. It is especially critical for your retirement years and for creating generational wealth for your family.

There is no better time to re-evaluate your current situation than the present. Connect with a licensed financial professional at Alfa Pride Financial, to assess where you are on your financial journey, and get the financial keys to a worry-free life. Get started today and book a call.

About the Author

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Xavier Williams is a licensed financial professional and member of the National Association of Insurance & Financial Advisors. He specializes in protection, wealth-building, and wealth-preservation strategies. He helps clients across the U.S. protect their families and businesses with insurance and financial products to secure a brighter future.

Comments ()